You must have done bank transactions at some point in your life. No matter what transaction you are going to make, you just need some important numbers. One of them is the routing number.

Whether you want to make a direct deposit, paycheck deposit, or order checks online, you will require both your bank’s routing number.

In this post, we will discuss an in-depth routing number. So let’s get started.

Table of Contents

What is Routing Number

The routing number is a nine-digit code assign to every bank in the US. It may also be known as an RTN (Routing Transit Numbers), an ABA (American Bankers Association) routing number, or Fedwire numbers.

The American Bankers Association (ABA) provided each bank with a unique code. It can be used to identify that particular bank when processing transactions.

The routing number concept was developed by the American Bankers Association in 1910. It identifies the specific financial institution assign with a routing number and responsible for the payment of a negotiable instrument.

To process domestic transactions, banks route payments through the United States Federal Reserve Bank. The Federal Reserve Bank uses a routing number to identify which bank the recipient holds an account with. Along with your routing number, the bank account number will also be needed for transactions.

Types of Routing Number

Many banks provide one routing number to customers. But some banks provide different routing numbers for a different transaction.

For example, the routing number for direct cash deposits and automated clearing houses also known as ACH transfers may be different from the one used for wire transfers.

So it is quite difficult to figure out which routing number is dedicated to the type of transaction you intend to make. In this case, you need to contact your bank for help.

When a Routing Number Is Used

There are several scenarios in which your routing number would be needed. For example, if you’re making an online payment or bill payments, you’ll need to provide your account number and routing number.

Also, if you’re processing bank checks or transferring money inside a country, you’ll be asked to provide your routing number. This guides the banks where to send money. It is mostly needed for the domestic transaction.

Where to Find Routing Number

There are several ways you can find the routing number.

On a check

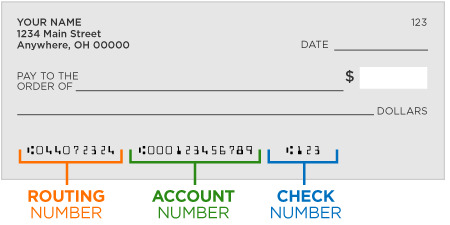

One of the easiest ways to find the routing number is on the bank check. Most banks provide a checkbook to customers.

The routing number generally printed in the bottom left-hand corner of a check. There would be three sets of numbers and the first set of numbers is the routing number.

These three number sets are usually separated by symbols, spaces, or a combination of both.

On bank website

Banks also lists routing number on their website. You can access it after login into the online portal. You can use the bank website or mobile app for login. After successful login, your account number, routing number, and more through your online account dashboard.

On the ABA website

The official website of ABA provides a routing number lookup facility. You will have to enter the bank’s name and its location to search for the number.

Contact your bank

You can easily contact your bank and ask for the routing number. Bank customer helpline numbers can be found on a bank website or mobile app.

Routing Number vs Account Number

There are major differences between the routing number and account number. The account number is unique for each account holder and identifies your specific account. Two persons can’t have the same account number.

The routing number depends on the bank location and other factors. It is needed for the identification of banks for various transactions.

|

Routing Number vs Account Number |

||

| What it identifies | Number of digits | |

| Routing Number | The location in which your account was opened | Nine digits |

| Account Number | Your personal account | Usually 10-12 digits |

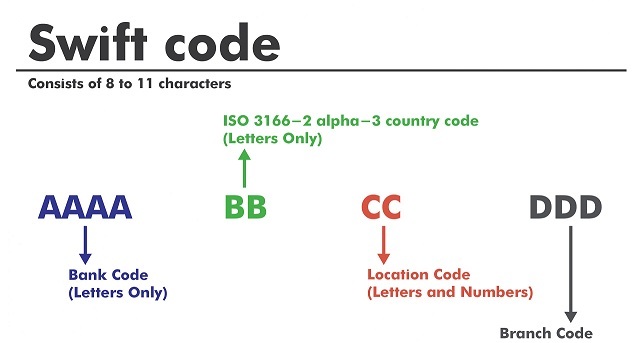

SWIFT Code vs Routing Number

SWIFT code and routing number are often confusing. The most significant difference between the SWIFT codes and routing numbers is whether you are sending payment domestic or international. If your payment is staying within your country, then the routing number will be used. If the payment is going internationally, then the SWIFT code will be used.

Let’s say you are a resident of the USA and have a bank account here. You want to send money to a friend inside your country. Then you would be required a routing number.

In another scenario, you want to send money to a friend located in France. Then you would be required to have their SWIFT code.

Conclusion

So these are some of the things you need to know about the routing number. It is very essential for various transactions and you need to know this. Above mentioned methods will help you to get the right routing number.